Is Elon Musk or Mukesh Ambani driving India’s electric revolution? Discover how Tesla India’s EV plans, Reliance’s green push, and the Tesla vs SpaceX stock story.

Elon Musk vs Mukesh Ambani: Two Billionaires, One Electric Future

Whether one talks about ambitious plans and spectacular shifts, there are few names that would glow as brightly as those of Elon Musk and Mukesh Ambani. Whereas Musk is a worldwide phenomenon when it comes to Tesla and SpaceX, Ambani is an Indian business titan transforming everything, including telecom and energy. However, the two are currently casting their eyes at a single large item: the electric vehicle (EV) revolution. Whereas Elon Musk is attempting to make Tesla India a reality, Ambani is establishing the EV infrastructure in India with Reliance. It is not only about cars; it is about who is developing the future of clean tech, mobility, and even the power to influence the stock markets.

Tesla India: Why Elon Musk’s EV Dream is Delayed

Elon Musk has planned to take Tesla to India, but then has encountered a snag. The greatest problem is Import duties. Musk is interested in trying out the market with the imported cars. However, the Indian government is hoping that Tesla will open a factory first a typical Make-in-India initiative. This give-and-take has stalled the Tesla entry into India. It is widely argued that a Tesla plant in India would make the cars’ prices drop and provide employment. However, till the time a deal is made, Tesla India is a waiting game. This action may influence not only the EV market but even Tesla shares in the whole world.

Tesla Stock: Can India Push It Higher in 2025?

In the last few years, Tesla stock experienced significant peaks and declines. But this much is certain: the global expansion and, particularly, entry into large markets such as India can influence the future of the stock. Provided that Tesla eventually comes to India in 2025, the investors can expect an elevation in the level of enthusiasm and the cost. India boasts of a massive young population, an increasing demand for EVs, and a government that promotes clean tech. Therefore, provided that matters go well with Musk, Tesla shares could get a boost with the EV bubble in India. Until the policy issues are sorted, though, it remains a large “if.”

ALSO READ: Lewis Hamilton’s Legendary Car Collection: AMG One, LaFerrari, P1 & More

SpaceX Stock & Elon Musk’s Empire Effect

Although SpaceX stock is not publicly traded yet, the increasing success of Elon Musk in space technology makes investors more confident in all his companies. The success of SpaceX in space missions and Starlink internet allows Musk to develop a good personal brand. That brand bleeds into Tesla as well. Lots of individuals invest in Tesla shares as they trust Musk’s long-term vision. Therefore, the success of SpaceX, although it is not publicly traded yet, gives extra sparks to the Tesla hype, particularly among Gen Z and millennial investors who seem to chase Musk like a rock star.

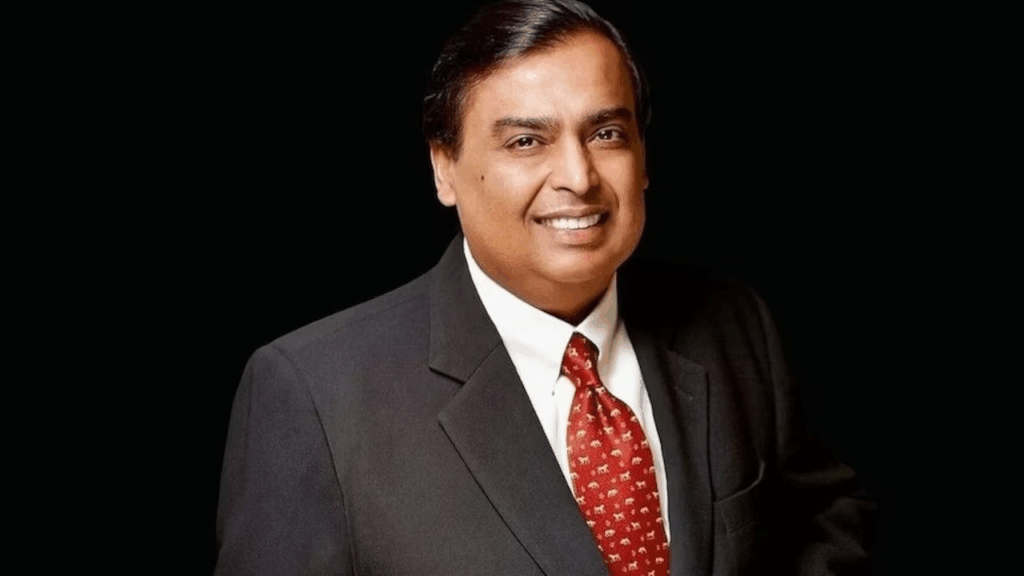

Mukesh Ambani’s Quiet Revolution: Is He Beating Musk in India?

As Elon Musk continues to make news, Mukesh Ambani is silently establishing the actual EV infrastructure of India. His company, Reliance, is betting on green hydrogen, battery storage, and EV charging infrastructure. He is not producing electric cars; however, he is providing all the energy they require. By the span of Jio and the scale of Reliance, Ambani could wind up managing the whole clean energy supply chain in India. Whereas Elon Musk is yet to make an entry, Mukesh Ambani has already started playing the long game, and he could very well win it.

Elon Musk and Mukesh Ambani are not just competing in the EV race of billionaires. It is about who will determine the future of energy, mobility, and innovation. Tesla India is likely to alter the game, provided Musk can decode the market. But Ambani is already constructing the tracks, laying the wires, and electrifying the future of India. Both may somehow triumph after all, in their own manner.

Think about this? Don’t forget to share it with your friends and family. Comment below!

Connect with us on social media for more exciting car and bike-related content!

Check out our Amazon Best Sellers: CLICK HERE